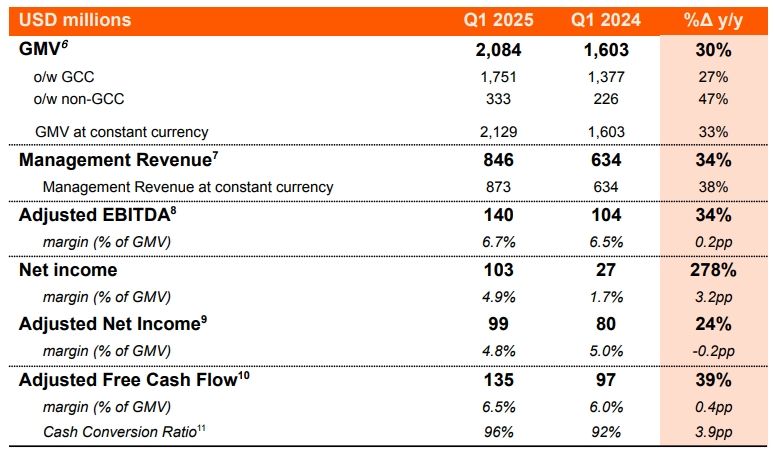

GMV grew 30% for the period versus the prior year to reach USD 2.1 billion. On a constant currency basis, GMV grew at a faster rate of 33%. Revenue grew 34% to reach USD 846 million for the period and, at constant currency, grew 38%. Adjusted EBITDA grew 34% to USD 140 million, or 6.7% of GMV, and net income grew almost four-fold to USD 103 million or 4.9% of GMV. On a normalised basis, adjusting for material non-recurring items to allow for a like-for-like comparison, net income grew 24% to USD 99 million or 4.8% of GMV.

This strong performance was driven by top line growth and margin expansion across both GCC markets (UAE, Kuwait, Qatar, Bahrain and Oman) and non-GCC markets (Egypt, Jordan and Iraq) as well as across both the Food and Grocery & Retail (“G&R”) verticals. The strong results were supported by increased resilience to the impact of Ramadan, thanks in part to an expanding G&R vertical which benefits from consumer behaviour trends during this period. Furthermore, the results reflected prior-year impacts related to ongoing geopolitical developments in the region, which had continued to weigh on performance during the comparative period.

Highlights for the period include:

GMV of USD 2.1 billion, up 30% year-on-year and 33% at constant currency.

- Strong double digit growth in the core GCC segment and Food vertical, and even faster growth in non-GCC markets and the G&R vertical, albeit from a lower base.

- Driven by customer acquisition, increased order frequency and talabat pro adoption, as well as base year effects.

- GMV geographical mix was 84% GCC and 16% non-GCC (prior year: 86% and 14%).

Management Revenue of USD 846 million, up 34% year-on-year and 38% at constant currency, representing a GMV-to-revenue conversion ratio of 41% (prior year: 40%).

Adjusted EBITDA of USD 140 million, up 34% year-on-year and equivalent to 6.7% of GMV (prior year: 6.5%).

Net income of USD 103 million, 3.8x the prior year level, and equivalent to 4.9% of GMV (prior year: 1.7%). Net income in the prior year was impacted by an FX loss on an intercompany loan to talabat’s Egyptian subsidiary following the Egyptian pound’s devaluation against the US Dollar in March 2024.

**Adjusted Net Income **of USD 99 million, up 24% year-on-year and equivalent to 4.8% of GMV (prior year: 5.0%), absorbing the impact of increased corporate income tax rates of 15% in the GCC markets.

Strong cash generation with Adjusted Free Cash Flow of USD 135 million, up 39% year-on-year, and equivalent to 6.5% of GMV (prior year: 6.0%) and a Cash Conversion Ratio of 96% (prior year: 92%).

Tomaso Rodriguez, Chief Executive Officer of talabat, commented: “We have had a strong start to the year, delivering excellent financial results that reflect the effectiveness of our strategy and execution. Our continued focus on enhancing the consumer value proposition, expanding across multiple verticals and deepening customer loyalty is driving sustained growth. Notably, our Groceries and Retail vertical contributed approximately one-third of GMV when including instashop for the full quarter, reinforcing the opportunity in scaling this vertical further. We also saw our most successful launch yet of talabat pro, our premium subscription loyalty programme, in Egypt, marking an important milestone and strengthening our offering in one of our fastest-growing markets.

“We were equally pleased to welcome the instashop team into our operations in the first quarter. As a leading grocery delivery e-marketplace in MENA, instashop is a strong strategic fit for talabat, and aligns closely with our ambition to expand and integrate our ecosystem. In a scale-driven business like ours, we expect to realise meaningful cost synergies as integration progresses over the next few quarters.”

Q1 2025 pro forma financial information:

The full set of disclosures today can be found within the Investor Relations section on talabat’s website at https://ir.talabat.com/financial-reports-and-presentations/